Short-sellers: the perfect scapegoat

For investors seeking an explanation for their losses that relieves them of the responsibilities of understanding financial markets and the limitations of their portfolio and investment strategy, the short seller is a perfect scapegoat. First, the idea that short sellers are driving prices down is plausible. Short selling, just like any other kind of selling, puts downward pressure on prices, so it is conceivable that downward price movement could be caused by short selling. Second, since many investors have never sold a stock short, short selling represents something foreign to them, making short sellers as a group easy to scapegoat. Third, envy and schadenfreude also help to make short sellers an attractive scapegoat, as they are generally the only ones profiting at the time when long investors are losing the most. "How dare they make money when my retirement fund took a 50% haircut?" Fourth, short sellers make for an ideal sound bite villain -- "Short sellers: profiting at your expense. News at 11." And lastly, some market participants would gladly have short sellers out of their hair for good.

The reality, however, is that in most cases short sellers are not responsible for the losses in the portfolios of long investors in any meaningful way. In many cases, short sellers actually help to improve the overall performance of long portfolios by reducing inflated purchase prices, discouraging fraud and deceit, and improving trading volume and liquidity. Here are some of the myths and facts about short short sellers:

![]() MYTH: short sellers profit from driving down the prices of undervalued stock

MYTH: short sellers profit from driving down the prices of undervalued stock

![]() FACT: profitable short sellers actually raise the prices of undervalued stock

FACT: profitable short sellers actually raise the prices of undervalued stock

The scenario of a short seller trampling the price an already struggling company is one of the most commonly used by short selling detractors to stir up outrage. A "bear raid" attempts to manipulate the price of a stock downward by first short selling it, causing a temporary drop in prices, and then buying the stock back at a lower price and pocketing the profit. In practice however (and in addition to being illegal), these simplistic price manipulations are very difficult to accomplish at a profit, especially for securities that are widely analyzed and have reasonable trading volumes.

Consider that this is the short-side equivalent of buying a stock long that's already overvalued with a price "bubble", to try to fan the flames in order to make it reach an even higher peak. It may pay off briefly, but like Warren Buffet likes to say, it is "like picking up pennies in front of a steamroller". Just ask the hordes of investors who lost everything in the 2000 dot-com bubble. Generally, bear raiders don't have a very long life expectancy.

In reality, successful short sellers short stocks that are overvalued, and when they become undervalued, they are actually buying the stock to close out their short positions -- the effect of which is to raise the prices of undervalued stocks.

![]() MYTH: "Naked" short selling caused stock prices to drop during the 2008 financial crisis.

MYTH: "Naked" short selling caused stock prices to drop during the 2008 financial crisis.

![]() FACT: The SEC put a stop to naked shorting in September 2008, but did nothing to stop the free fall of stock prices, proving that naked shorting was not to blame.

FACT: The SEC put a stop to naked shorting in September 2008, but did nothing to stop the free fall of stock prices, proving that naked shorting was not to blame.

Prior to the SEC's ban on naked short selling in September 2008, there was a lot of fear, uncertainty, and doubt about the effect of naked shorting on stock prices. ("naked" short selling is short selling a stock without actually borrowing it, allowing more short orders to be placed than there are shares available for borrowing.) Many saw the correlation between "fails to deliver" (often an earmark of naked shorting) and price drops as evidence that naked shorting was causing the price drops.

As it turns out, the rampant naked shorting was merely a side effect of the increased short-side speculation than naturally occurs when prices drop, combined with lax trade settlement procedures. It was not the cause of price drops. The SEC proved it in September of 2008, when it effectively ended naked shorting, and massive price drops continued for many months to follow.

![]() MYTH: Short selling caused the price drops of financial stocks in the 2008 financial crisis..

MYTH: Short selling caused the price drops of financial stocks in the 2008 financial crisis..

![]() FACT: The SEC's ban on all short selling of financial stocks failed to stop their price slide, proving that short selling was not to blame.

FACT: The SEC's ban on all short selling of financial stocks failed to stop their price slide, proving that short selling was not to blame.

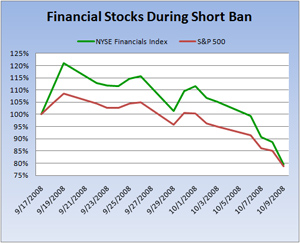

In September of 2008, the SEC completely banned short short selling of financial stocks as an emergency temporary measure to try to stabilize their prices, which had been dropping precipitously. During the three weeks that the ban was in place, financial stocks made brief recovery, then resumed their downward slide the same as they had done prior to the ban. By the end of the ban, financial stocks had dropped over 20%, roughly the same as the rest of the market in which the ban was not present, proving that short selling was not a significant driver of the financial stocks' price drops. And when questioned on December 31, 2008 about the SEC's decision to implement the ban, former Chairman Christopher Cox even admitted "Knowing what we know now, [we] would not do it again. The costs appear to outweigh the benefits."

About the author: Steve Smith is a professional investor with a portfolio containing both long and short investments.

© 2010 smitherspoon.com